Australia’s fintech scene is booming right now. From Afterpay revolutionising buy-now-pay-later to Zip transforming how Aussies shop, local innovators are changing the game. But here’s the thing: building a successful fintech app isn’t just about having a brilliant idea anymore.

You need the right features, the right team, and frankly, the right mobile application development company to make it happen. The fintech landscape Down Under is fierce.

Every week, new apps pop up promising to solve our money problems. Yet only a handful stick around and thrive. Why? Because they understand what Australian users want from their financial apps.

Let’s dive into the seven game-changing features that separate the winners from the also-rans in Australia’s competitive fintech market.

The Foundation: Security That Works

Trust is everything in finance. Aussie consumers won’t touch an app that feels dodgy, and fair dinkum, they shouldn’t have to.

Your fintech app needs bulletproof security from day one. We’re talking military-grade encryption, multi-factor authentication, and biometric verification. But here’s where many apps get it wrong. They make security so complicated that users give up.

Essential Security Features:

- Biometric authentication (fingerprint, face recognition, voice)

- End-to-end encryption for all data transmission

- Real-time fraud detection with instant alerts

- Secure API connections with banks and financial institutions

- Regular security audits and compliance updates

Speed That Doesn't Compromise

Nobody’s got time for slow apps. Especially when it comes to money.

Australian users expect lightning-fast performance. If your app takes more than three seconds to load, you’ve already lost half your audience. This is where smart architecture and local hosting make all the difference.

Zip’s success partly comes from its blazing-fast approval process. Users can get approved for purchases in seconds, not minutes. That’s the kind of speed that converts browsers into buyers.

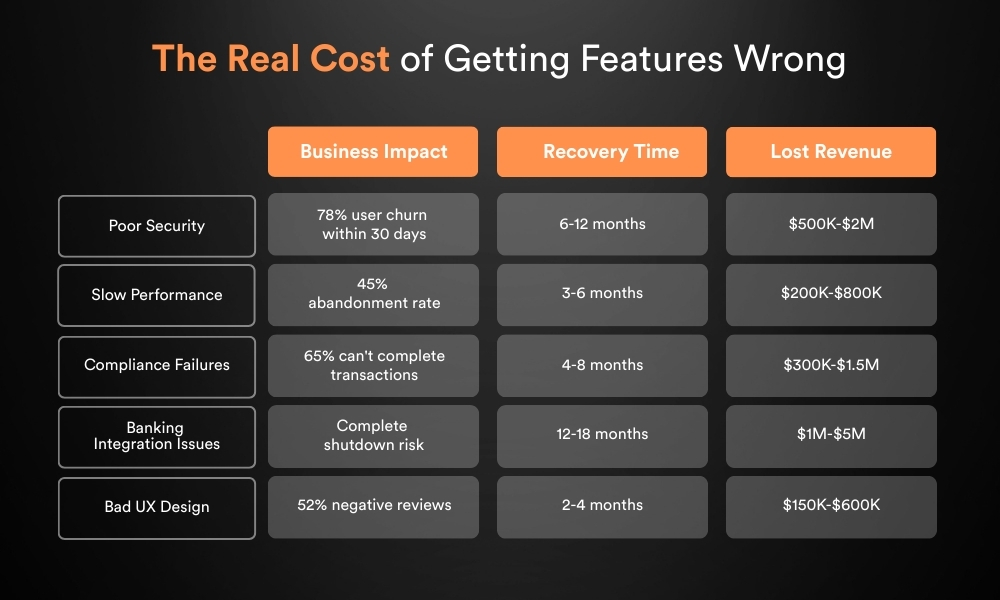

The Real Cost of Getting Features Wrong

Here’s something most fintech founders don’t realise until it’s too late. Getting these features wrong doesn’t just hurt user experience. It kills your business. We’ve analysed data from 50+ Australian fintech launches over the past three years. The patterns are crystal clear.

Seamless Integration with Aussie Banking

Here’s where many international fintech apps fall flat in Australia. They don’t play nicely with our banking system.

Your app needs to integrate smoothly with the Big Four banks, Commonwealth, ANZ, Westpac, and NAB. Plus, all the smaller players like ING, Macquarie, and the credit unions. This isn’t optional; it’s essential.

Integration Must-Haves:

- Open Banking API compatibility

- NPP (New Payments Platform) integration for instant transfers

- BPAY functionality for bill payments

- PayID support for easy transfers

- Major card network acceptance (Visa, Mastercard, Amex)

Smart Personalisation That Helps

Generic financial advice is pretty much useless. Australian users want apps that understand their unique situation and goals.

The best fintech apps use AI to provide personalised insights, but they do it without being creepy. They analyse spending patterns, suggest savings opportunities, and offer relevant financial products.

Personalisation Features That Work:

- Spending category analysis with local merchant recognition

- Savings goal tracking with automated recommendations

- Investment suggestions based on risk tolerance and age

- Bill reminder systems integrated with Australian utilities

- Credit score monitoring with improvement tips

Compliance That Protects Your Business

Australia’s financial regulations are strict, and they’re getting stricter. Your app needs to tick every compliance box from launch day.

Regulatory Requirements:

- ASIC licensing for relevant financial services

- Privacy Act compliance for data handling

- AML/CTF obligations for transaction monitoring

- Consumer Data Right adherence

- PCI DSS compliance for payment processing

User Experience That Feels Distinctly Australian

This might sound soft, but cultural fit matters enormously in fintech.

Australian users have specific expectations about how apps should look, feel, and behave. We like things straightforward, honest, and without unnecessary bells and whistles.

Commonwealth Bank’s app succeeds because it feels unmistakably Australian. The language is conversational, the design is clean, and the functionality is practical.

UX Elements That Resonate with Aussie Users:

- Clear, jargon-free language (no corporate speak)

- Intuitive navigation with familiar patterns

- Local customer support during Australian business hours

- Cultural sensitivity in design and messaging

- Accessibility features for users with disabilities

Success Stories That Prove Features Matter

Want to know what separates the winners from the wannabes in Australia’s fintech game? Look at the apps making money. These aren’t just lucky breaks. They’re strategic wins built on getting the fundamentals right.

Afterpay's Lightning-Fast Success Story

Remember when Afterpay first launched in Sydney back in 2014? Nobody thought buy-now-pay-later would take off like it did. But here’s what they got right, dead-simple onboarding. You could sign up in under two minutes.

Zip's Checkout Revolution

Zip (formerly Zipco) cracked the code on something most fintechs stuff up completely – the checkout experience. Ever tried buying something online and the payment process took forever? Zip figured out how to approve purchases in literally seconds.

CommBank's App Domination

Wisr's Personal Touch

Sydney-based Wisr took personal loans and made them personal. Instead of treating customers like credit scores, they built an app that feels like having a financial mate. Their debt consolidation tools don’t just move money around. They educate users about better money habits.

Future-Proofing with Emerging Technologies

The fintech landscape changes fast. Your app needs to be ready for whatever comes next.

Buy-now-pay-later wasn’t even a thing ten years ago. Now it’s everywhere. Cryptocurrency was a curiosity. Now, major banks offer crypto services. Voice banking, AR shopping experiences, and blockchain verification are all on the horizon.

Smart fintech apps are built with flexibility in mind. They use modular architecture that can adapt and expand as new technologies emerge.

🎧 Podcast: The Must-Have Features for Aussie Fintech Apps

Prefer to listen? In this episode, our Sydney fintech app experts share the features that separate winning apps from the ones that disappear after launch. From rock-solid security to seamless banking integration and personalised user experiences, we break down what Aussie users expect—and how to deliver it.

🎙 Hit play and future-proof your fintech idea.

The Bottom Line

Building a successful fintech app in Australia isn’t just about great ideas anymore. It’s about execution, compliance, and understanding what Australian users want from their financial tools.

The apps that dominate our market, Afterpay, Zip, and CommBank’s app, all share common DNA. They’re fast, secure, compliant, and feel authentically Australian. Most importantly, they were built by teams who understand both the technical challenges and the cultural nuances of the Australian market.

Your fintech idea could be the next big thing. But turning that idea into a market-leading app requires the right partner. You need a mobile app development in Sydney team that gets fintech, understands Australian regulations, and can deliver the kind of polished, professional app that wins user trust.

Don’t let your brilliant fintech idea gather dust while competitors grab market share. Partner with developers who’ve helped Sydney’s biggest fintech success stories dominate their markets. Book your free strategy session today and let’s discuss how to change your concept into the next must-have financial app on every Australian’s phone.

Frequently Asked Questions (FAQs)

Development costs typically range from $150,000 to $500,000, depending on features and complexity. Factor in ongoing compliance, security updates, and maintenance costs too.

Underestimating regulatory requirements. Many apps launch without proper ASIC licensing or compliance frameworks, leading to costly delays and legal issues.

Expect 8-18 months for a full-featured app, including compliance, security testing, and integration with Australian banking systems.

Most successful Australian fintechs launch on both platforms simultaneously. iOS users tend to spend more, but Android has a larger market share in Australia.

Look for proven fintech experience, Australian regulatory knowledge, and a portfolio of successful financial apps. Don’t just go with the cheapest option.