Artificial intelligence is now transforming the finance industry. It helps banks to provide instant customer support and also supports split-second fraud detection.

Automated knowledge management and investment research are some of the greatest perks of AI in financial management. AI is making financial services faster, smarter, and more secure.

The global AI in Finance market was valued at USD 38.36 billion in 2024 and it’s on track to reach USD 190.33 billion by 2030. That’s a massive growth rate of 30.6% per year. Companies that partner with an AI development company are already seeing the benefits.

How AI Transforms Key Areas of Finance?

Customer Experience Gets Personal

AI Chatbots now handle routine customer questions instantly. They’re available at 3 AM on weekends. They remember previous conversations. They can pull up account details and transaction history in seconds.

But modern AI goes deeper. These systems analyse spending patterns to recommend relevant products. They notice when financial situations change and offer helpful resources. They provide investment advice that was once reserved for high-net-worth clients.

The result? Customers get faster service and more relevant solutions.

Decision-Making Becomes Data-Driven

AI systems analyse thousands of data points simultaneously. Stock prices, economic indicators, news sentiment, social media trends, weather patterns, political developments—everything gets factored into the analysis.

This comprehensive approach leads to better outcomes:

- Investment portfolios perform more consistently

- Loan default predictions become more accurate

- Insurance pricing reflects actual risk levels

- Market timing improves significantly

Fraud Detection Prevents Problems

Old fraud detection systems were reactive. AI flips this model entirely.

Machine learning monitors every transaction in real-time. It knows normal spending patterns for each customer. A coffee purchase at the usual café gets approved instantly. A jewellery purchase in another country triggers immediate verification.

The improvements are dramatic:

- Fraud detection accuracy jumps

- False positives drop

- Customer complaints about blocked cards plummet

- Actual losses from fraud decrease significantly

Operations Run Smoother

Back-office operations used to require armies of employees. Processing loan applications, reviewing insurance claims, generating compliance reports—all done by hand.

AI automates these repetitive tasks while improving quality. Loan applications that once took weeks now get processed in hours. Insurance claims get reviewed automatically, with human oversight only for complex cases.

Compliance reports are generated automatically with real-time data updates. This frees up human employees for relationship building and strategic planning.

Robo-Advisors Democratize Investing

Robo-advisors and AI-powered platforms enable anyone with $100 to invest to create diversified portfolios. They rebalance automatically. They harvest tax losses. They adjust strategies as life circumstances change.

Young professionals get growth-focused portfolios. Retirees get income-focused strategies. Risk-averse investors get conservative allocations and aggressive traders get higher-volatility options.

Alternative Credit Scoring Opens Doors

Traditional credit scores leave many people behind. Students with no credit history can’t qualify for loans. Small business owners with irregular income patterns may encounter complexities when scaling.

AI expands the conversation by analysing alternative data:

- Rent and utility payment history

- Bank account management patterns

- Mobile phone usage and payment consistency

- Social media and professional network analysis

This broader view helps lenders serve previously “invisible” customers. College graduates and immigrant entrepreneurs can get their first credit cards.

Automated Compliance Reduces Risk

Financial regulations change constantly. Manual processes create opportunities for expensive mistakes.

AI monitors compliance continuously. It scans transactions for suspicious patterns. It generates the required reports automatically. It flags potential violations before they become regulatory problems.

When new regulations take effect, AI systems adapt faster than human teams ever could. This prevents costly compliance failures while reducing the burden on internal staff.

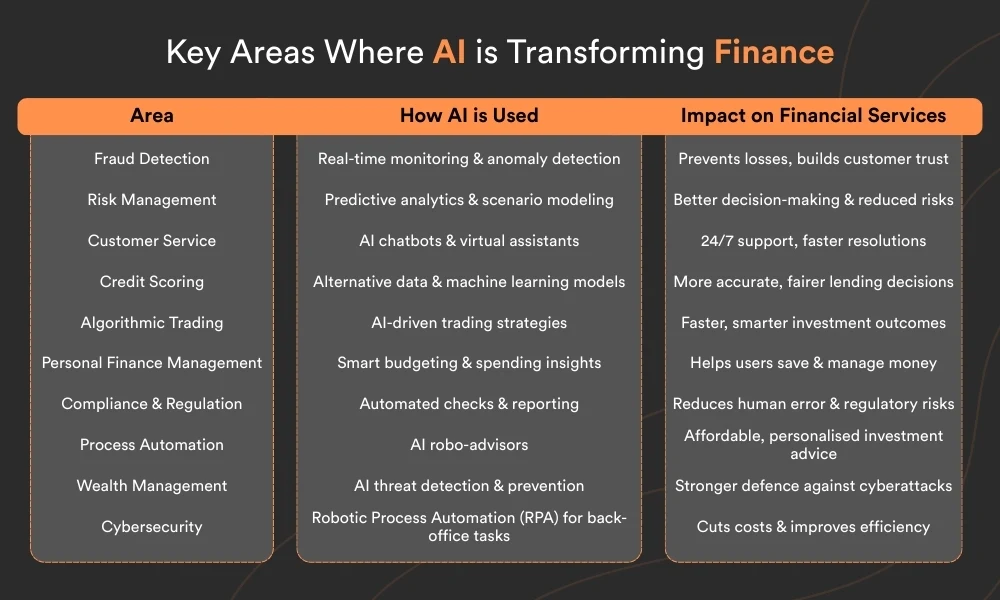

Key Areas Where AI is Transforming Finance

Working With AI Development Partners

Most financial institutions don’t build AI systems internally. The specialised expertise required makes partnerships more practical and cost-effective.

The best AI development company partners understand financial services deeply. They know regulatory requirements. They’ve solved similar problems for other clients. They provide ongoing support as systems evolve.

🎧 Podcast: How AI is Reshaping the Financial Services Industry

Prefer listening? In this episode, our AI experts break down how artificial intelligence is revolutionizing banking, insurance, and financial services in Australia. We cover customer experience, fraud detection, compliance automation, and the future of AI in finance.

Wrapping Up

Smart financial institutions are already seeing the results of AI implementation. Their customers get better service, and their operations run more efficiently.

The right AI development services can help you implement solutions that deliver real results without disrupting your existing operations. Connect with an AI development company

Frequently Asked Questions (FAQs)

Chatbots answer simple questions instantly. They can check balances, explain fees, and even help dispute charges. No more waiting, no more business hours restrictions. Plus, these systems learn what each customer needs and start offering relevant suggestions.

AI systems can track hundreds of market indicators simultaneously. It factors in news events, weather patterns, and economic reports. They don’t get tired or affected by emotions. The analysis is unbiased. That combination leads to more consistent results over time.

Many community banks and credit unions are already using AI successfully. They partner with an AI development company that provides ready-made solutions.

AI is more like having a detective who knows every customer’s normal behaviour. When something seems off – like a purchase in an unusual location or an atypical spending pattern – it flags the transaction immediately.

AI implementation isn’t cheap upfront. But the technology pays for itself surprisingly quickly. When you automate loan processing, fraud detection, and customer service, the operational savings add up fast. Most AI development services now offer flexible payment structures that tie costs to actual results rather than requiring huge upfront investments.