Setting up the perfect payment gateway for your Magento store can make or break your customer experience. With countless options available and the growing complexity of Australian payment regulations, partnering with a skilled Magento development in Sydney team ensures you’re making the right choice from day one.

Why Your Payment Gateway Choice Matters More Than Ever?

Australian online shoppers are increasingly savvy about payment security and convenience. A clunky checkout process or limited payment options can send potential customers straight to your competitors. Your payment gateway isn’t just a transaction processor—it’s the final handshake between your brand and your customer’s wallet.

The stakes are high. Studies show that 27% of Australian online shoppers abandon their cart due to payment complications, while 43% expect multiple payment options at checkout.

Essential Features Every Aussie Magento Store Needs

Security First: PCI DSS Compliance and Beyond

Your payment gateway must tick these security boxes:

- PCI DSS Level 1 certification (non-negotiable for Australian merchants)

- 3D Secure authentication for enhanced fraud protection

- SSL encryption and tokenisation for sensitive data

- Real-time fraud monitoring with Australian spending pattern recognition

Local Payment Method Support

Australian shoppers expect familiar payment options:

- BPAY integration for traditional bill payments

- PayPal and Afterpay for flexible payment terms

- Apple Pay and Google Pay for mobile convenience

- Direct bank transfers for high-value purchase.

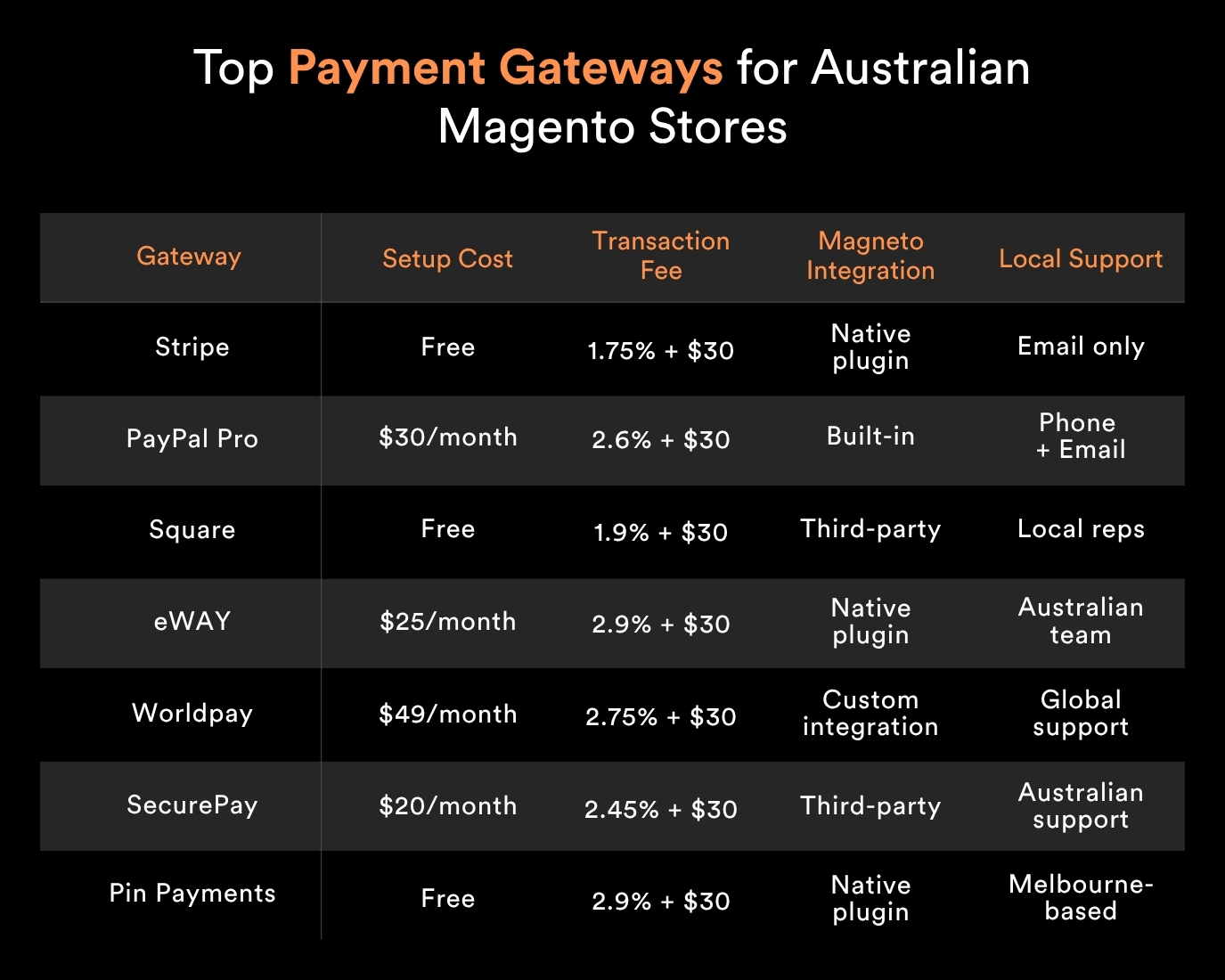

Top Payment Gateways for Australian Magento Stores

The Australian market has some bloody brilliant payment gateway options, but not all play nicely with Magento. Here’s the lowdown on what works Down Under.

Integration Complexity: What to Expect

Simple Integrations (1-2 days):

- PayPal Standard

- Stripe basic setup

- Square online payments

Moderate Integrations (3-7 days):

- eWAY advanced features

- PayPal Pro with custom styling

- Multiple gateway setups

Complex Integrations (1-3 weeks):

- Custom payment flows

- Multi-currency setups

- Enterprise-grade fraud protection

Real Australian Success Stories

Some of our most successful Aussie brands have nailed their payment gateway game. Let’s have a squiz at what they did right.

Bonds successfully integrated Afterpay with their Magento store, seeing a 35% increase in average order value among younger demographics. Their Magento web development in Sydney team implemented seamless buy-now-pay-later options that aligned perfectly with their brand’s accessibility focus.

Temple & Webster leveraged multiple payment gateways through their Magento platform, offering everything from traditional credit cards to newer digital wallets. This flexibility contributed to their 40% year-on-year growth in online sales.

Cost Considerations: Beyond Transaction Fees

Don’t get caught out by sneaky fees that pop up after you’ve committed to a gateway. Here’s what you need to budget for beyond the obvious transaction costs.

Hidden Costs to Watch For

- Monthly gateway fees (often overlooked)

- Chargeback fees ($15-$25 per dispute)

- International transaction surcharges (up to 3.5%)

- PCI compliance fees ($25-$50 monthly)

- Integration development costs ($500-$5000, depending on complexity)

ROI Calculation Tips

Calculate your break-even point by considering:

- Current conversion rates vs. projected improvements

- Average order value changes with new payment methods

- Customer lifetime value increases froman improved experience

- Reduced cart abandonment rates (industry average: 15-20% improvement)

Implementation Best Practices

Getting your payment gateway up and running isn’t just about plugging it in and hoping for the best. Here’s how to do it properly.

Testing Your Setup

Before going live, thoroughly test:

- Sandbox transactions with various card types

- Refund processing workflows

- Failed payment handling and retry logic

- Mobile payment functionality across devices

Monitoring and Optimization

Track these key metrics post-launch:

- Conversion rates by payment method

- Transaction success rates during peak times

- Customer support tickets related to payments

- Chargeback ratios and dispute patterns

Future-Proofing Your Payment Strategy

The payments game is changing faster than a Sydney train timetable. Stay ahead of the curve with these emerging trends.

Emerging Trends in Australian Payments

The payment landscape evolves rapidly. Keep an eye on:

- Cryptocurrency acceptance (Bitcoin, Ethereum)

- Voice-activated payments through smart speakers

- Biometric authentication for enhanced security

Real-time payment rails for instant settlements

Regulatory Considerations

Stay compliant with Australian regulations:

- AUSTRAC reporting requirements for large transactions

- ACCC guidelines on payment surcharging

- Privacy Act compliance for customer data handling

🎧 Podcast: Choosing the Right Payment Gateway for Your Magento Store

Prefer tuning in instead of reading? In this episode, we chat with our Sydney-based Magento experts about what really matters when picking a payment gateway. From hidden fees to integration pitfalls and must-have features for Aussie shoppers—we cover it all.

Get real insights, avoid rookie mistakes, and make checkout your store’s secret weapon.

Making Your Final Decision

Choosing the right payment gateway for your Magento store isn’t just about transaction fees—it’s about creating a seamless experience that builds customer trust and drives sales. Consider your target audience, average order values, and growth plans when making this crucial decision.

Working with an experienced Magento web development in Sydney team ensures your payment integration is secure, compliant, and optimised for the Australian market. The right gateway choice today sets the foundation for your eCommerce success tomorrow.

Book your free 30-minute payment gateway consultation today. We’ll assess your current setup, recommend the best-fit payment gateway for your business—no cost, no strings attached. Contact us today to get started.

Frequently Asked Questions (FAQs)

Absolutely! Most Australian merchants benefit from offering 3-4 payment options. Your Magento development company can configure multiple gateways to give customers maximum flexibility while optimising your transaction costs.

Simple integrations can be completed in 1-2 days, while complex custom setups may require 2-3 weeks. The timeline depends on your specific requirements and the chosen gateway’s complexity.

Yes, you must comply with AUSTRAC reporting for transactions over $10,000, follow ACCC surcharging guidelines, and ensure PCI DSS compliance. Local payment processors often handle much of this automatically.

Implement a backup payment gateway and real-time monitoring. Most professional Magento setups include failover systems that automatically switch to secondary gateways during outages.

While transaction fees vary by 0.5-1%, consider monthly fees, setup costs, and integration complexity. A gateway that’s 0.2% more expensive but reduces cart abandonment by 10% often provides better ROI.